Implications, Debates, and Future Outlook in the Cryptocurrency Market

Understanding Bitcoin Halving and Its Impact on the Cryptocurrency Market

Bitcoin, the world’s most renowned cryptocurrency, is known for its volatility and rapid price fluctuations. With another halving event on the horizon, the discussion surrounding its potential impact on Bitcoin’s value has gained significant momentum. In this article, we delve into the key aspects of Bitcoin halving, exploring its implications, and shedding light on the ongoing debates among enthusiasts and skeptics.

The Genesis of Bitcoin and the Role of Miners

Unraveling the origins of Bitcoin, we delve into how Satoshi Nakamoto, its pseudonymous creator, designed a system where new coins are generated through mining activities. Miners, utilizing specialized computers, validate transactions on the blockchain, a transparent public digital ledger. Discover how miners compete for block rewards, earning newly issued tokens known as Bitcoins.

Understanding Bitcoin Halving and Its Mechanism

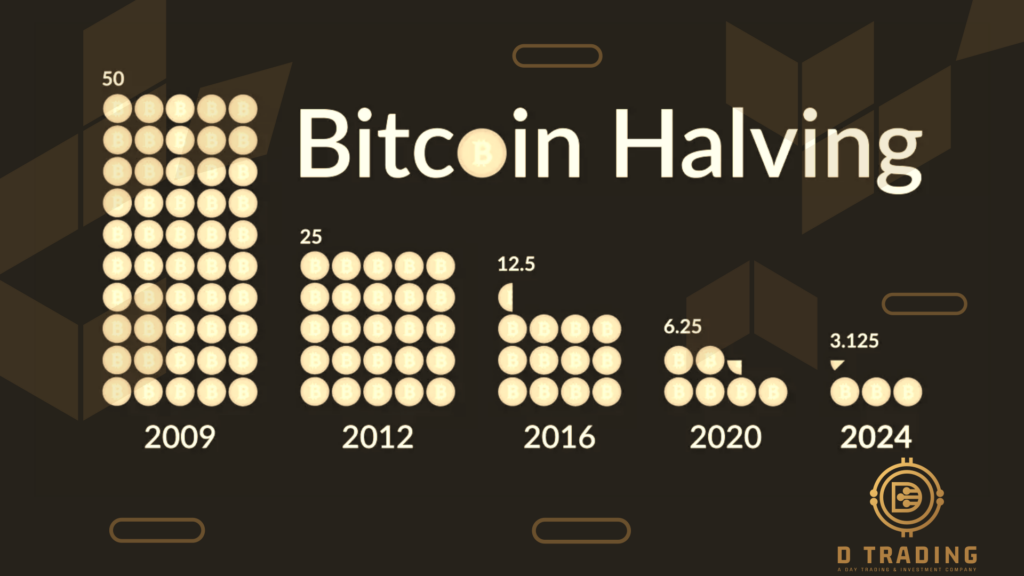

Bitcoin halving is a planned event that occurs approximately every four years or after every 210,000 blocks. We explore the concept behind halving and its significance in the cryptocurrency ecosystem. Each halving event results in a 50% reduction in block rewards received by miners. Starting with an initial block reward of 50 Bitcoins, subsequent halvings have lowered it to 25 in 2012, 12.5 in 2016, 6.25 in 2020, and the forthcoming halving is expected to bring it down to 3.125 coins in 2024.

Scarcity and Inflation Control in Bitcoin

We discuss how Bitcoin’s issuance is fundamentally limited, with a maximum of 21 million coins determined by its founding protocol. This characteristic attracts individuals concerned about inflation risks associated with government-issued fiat currencies. Gain insights into the argument made by Bitcoin supporters that its limited supply guarantees the potential for value appreciation. Furthermore, learn how halving events act as a mechanism to control inflation by moderating the rate at which new Bitcoins are created, aligning with market demand.

Timing and Future Outlook of Bitcoin Halving

With the next Bitcoin halving event projected to occur around April 2024, we explore the factors that can influence the precise timing. Industry estimates suggest that there will be 64 halvings in total before the 21 million Bitcoin maximum is reached, expected around 2140. Discover the implications for miners when this limit is reached, as they transition to relying solely on transaction fees.

Debates Surrounding the Price Impact of Halving

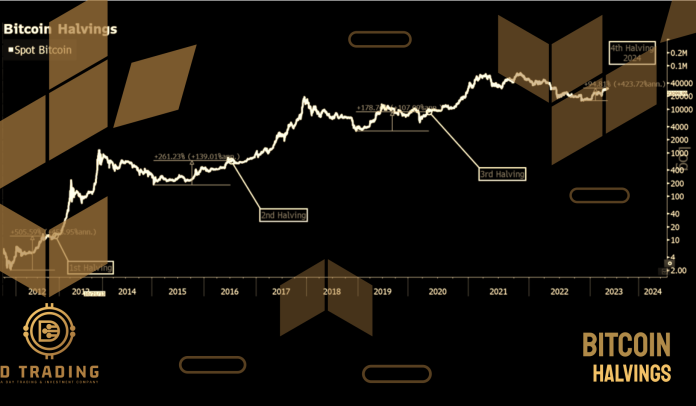

We analyze the ongoing debate surrounding the correlation between Bitcoin halvings and price movements. Historical data indicates significant price increases following previous halvings, such as the approximately 8,000% surge in Bitcoin’s price after the 2012 halving and the subsequent rise of nearly 1,000% following the 2016 halving. However, skeptics argue that attributing price increases solely to halving events is speculative, pointing to other factors such as mainstream recognition and market dynamics.

Impact on Bitcoin Owners and Price Fluctuations

We discuss how the halving event itself does not directly impact Bitcoin ownership. However, subsequent price changes can influence the value of Bitcoin holdings. Emphasizing the challenge of precisely isolating the influence of halving events on price fluctuations, we provide insights into the broader market dynamics that should be considered by Bitcoin owners.

Navigating the Impact of Bitcoin Halving in a Dynamic Market

As the next Bitcoin halving event approaches, the cryptocurrency community is engaged in active discussions regarding its potential impact on the digital asset’s value. While historical trends suggest a positive correlation between halvings and price increases, skeptics stress the role of various market factors. Understanding the dynamics of halving events is crucial for investors and enthusiasts navigating the ever-evolving landscape of cryptocurrencies.

Remember to implement relevant on-page optimization techniques, such as including appropriate keywords, structuring the content with headings, and providing a clear and concise meta description. Additionally, ensure your website follows best practices for SEO, such as fast page load times, mobile responsiveness, and high-quality backlinks, to improve its ranking on Google and attract organic traffic.

1 Comment

Johan De Boevere

Thank you for this informative post. Now I understand better why Bitcoin has continued to rise in the past. I personally bought some in 2021, and this post reassures me that I don’t have to sell at a loss. With the ongoing downward price trend, it’s easy to feel disheartened. So, if I understood correctly, you expect a rise in value due to the halving event in 2024?